1/ Holding #DeFi blue chips is great. Farming them is a plus. So today, i will tell you where is the best place to farm $CVX (3 digits yield, yes sir)!Ofc, non financial advise. I'm contributor on some projects there, but the below is fair and full of facts !Enjoy! 👇

2/ this thread is an update on this one covering also $CRV for small PF and newcomers:

2022-07 - Yield Optimizer List

3/ Best place to check first is @0xNanoly which is an amazing tool. It's an aggregator of farming yields across almost all Chains. You won't find ALL strategy, but most of them.

Here is the list for $CVX.

https://nanoly.com/name:CVX-sort:apy:desc

4/ Now Let's sort the different farming yield from low to high for each type of strategy!

===============>

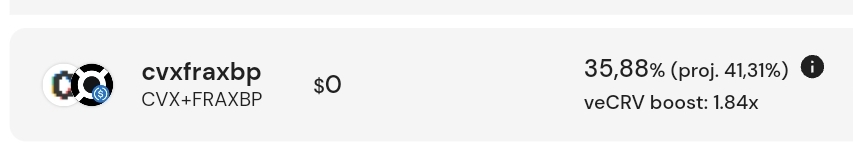

4.1/ Farming in Liquidity Pool4.1.1- 36% APR: Volatile LP CVX/FraxBP on @ConvexFinanceRisk: impermanent LossPro: The only LP CVX/Stable + incentivized by @fraxfinance

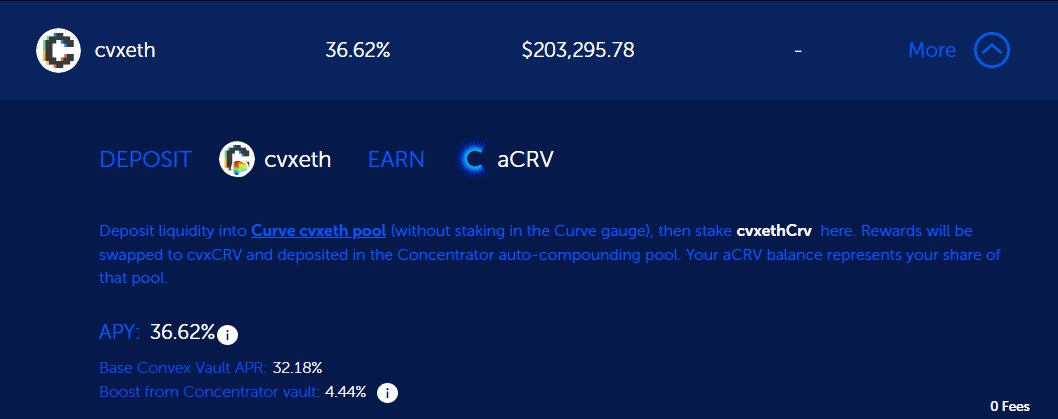

4.1.2- 37% APY: Volatile LP CVX/ETH on @0xconcentratorRisk: Impermanent lossPro: Better yield than on Convex thanks to farming $aCRV as part of the strategy.

4.1.3- From 31% to 78% APR on clevCVX/CVX pool (50/50) on @0xC_Lever -> Pool deployed on