1/ YIELD OPTIMIZER LIST on top of @ConvexFinance & @CurveFinance1/10 You know i’m a fan of #DEFI tokens & holding them in my #WEB3 wallet 🤮 So how can I try to generate Yields from $CRV and $CVX tokens? Here is my 🧵for ppl who 1)have small portfolio 2) are beginners in #DeFi 👇

2/ Llama Airforce:

For: $CVX lockers on @ConvexFinance

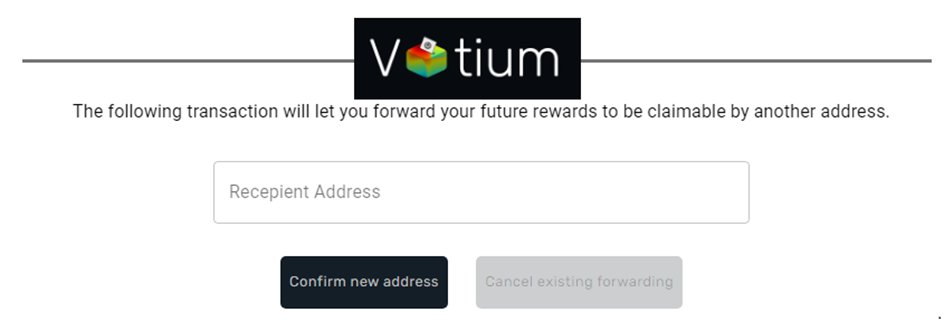

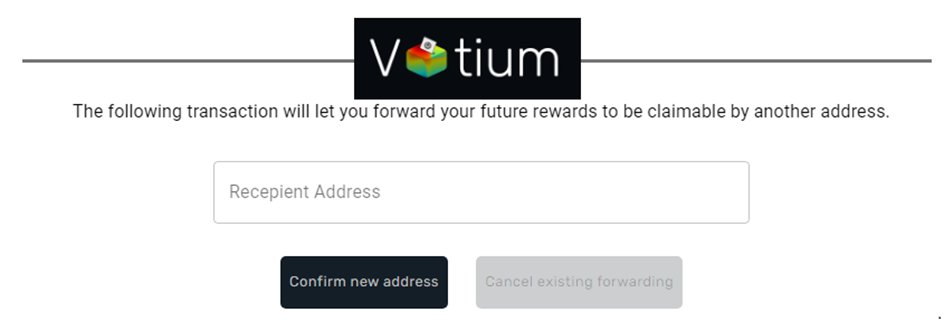

How: Redirect bribes from @VotiumProtocol

Benefit: Bribe rewards swaped into $cvxCRV and staked in an autocompounder Yield: 43% APY

Llama Airforce: llama.airforce/#/union/member

Votium: votium.app

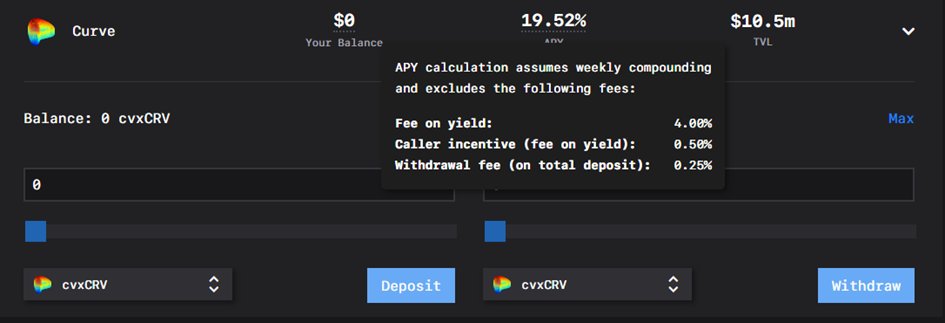

3/ Llama Airforce:

For: $CRV Holders

How: Deposit $cvxCRV or any selected token using Zap-In function on Llama Airforce

Benefit: Auto-compounder using $CRV staking solution from @ConvexFinance

Yield: 19,5% APY

4/ Llama Airforce:

Can't talk about @CurveFinance & @ConvexFinance without @fraxfinance

For: $FXS Holders

How: Deposit $FXS or any selected token using Zap-In function on Llama Airforce

Benefit: Auto-compounder using $FXS staking solution from @ConvexFinanceYield: 51% APY

5/ @redactedcartel: