1/ I've been deeply following @synthetix_io lately, and fundamentals + financials figures are touching the sky. So if you invested in it, here is a simple guide for #DeFi Noobs about #staking $SNX on @synthetix_io platform 🧵👇And read it carefully!

2/ First, staking is done on #L2 #Optimism #blockchain https://staking.synthetix.io/

Current APR is 57,21%.

Rewards are in $sUSD - #StableCoin & $SNX. Tokens MUST be claimed every week before the end of each epoch (Wed. at 09:00 UTC) -> Otherwise, rewards go back to the pool.

3/ $SNX rewards do not go directly into your #web3 wallet, instead, claimed $SNX are escrowed on this webpage staking.synthetix.io/escrow , and you can get them back in 12 months from the claim date. In the mean time, you can stake them, and increase your staked amount of $SNX

4/ When you Stake $SNX, you mint $sUSD. Take this as if you were borrowing $sUSD with $SNX as a collateral, and with the same risk of "Liquidation". In order to unstaked your $SNX, you need to redeem $sUSD. But, now things get a bit more complex.

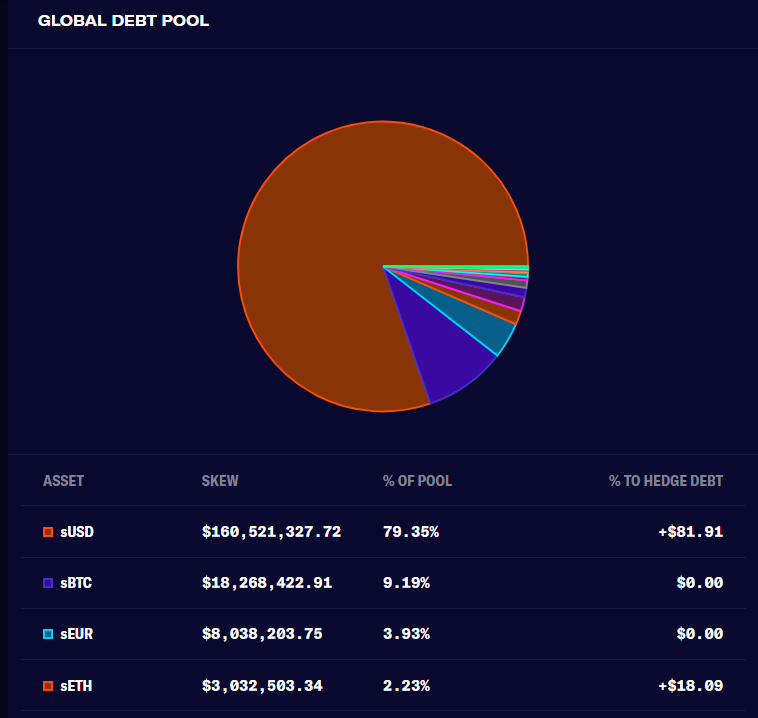

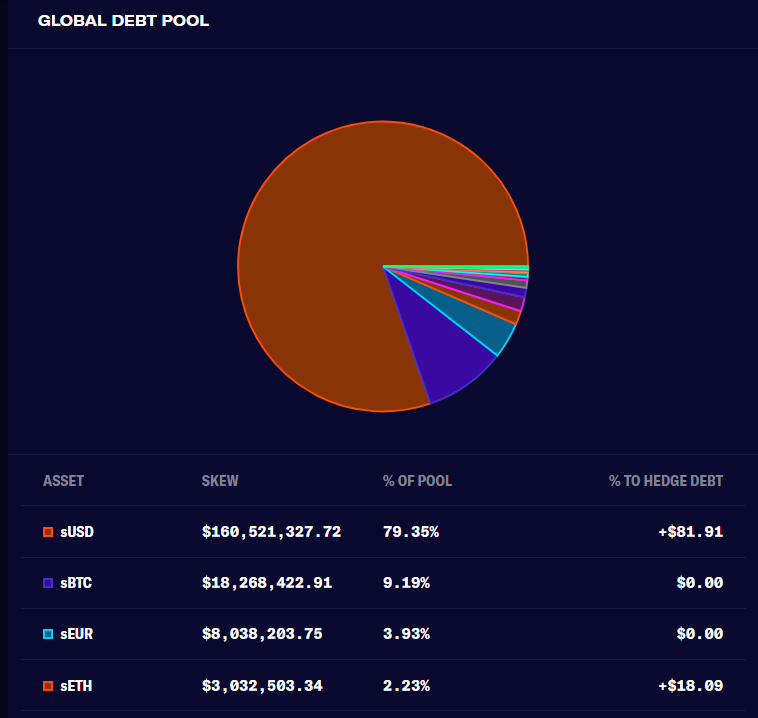

5/ Your debt is not your "borrowed", aka minted, $sUSD, but it's a share of the global debt of the protocol. The debt pool represents the total value of all Synthetic Assets in the system. Here is a today extract. Very interesting the rise of $sEUR holdings.

6/ Your #collateral ratio, called C-RATIO, MUST be >= to 400% (value may change depending on Gov. Vote) to receive rewards. If your C-RATIO < 400%, you won't receive your weekly reward. So How your C-RATIO can be impacted?

7/ You need to maintain C-RATIO to 400%. C-RATIO = Staked $SNX / Your share of Debt Pool. Variables here are:1) If $SNX price goes ⬇️, C-RATIO ⬇️2) If Dept pool goes ⬆️, C-RATIO ⬇️

8/14 If your C-RATIO < 150%, you must recover the set C-RATIO in 12h, otherwise you will be LIQUIDATED. Your $SNX position + a max of 30% penalty will be used to pay your debt, leaving a min of 20% of your staked position.

How can you managed your C-RATIO?

New Liquidation Mechanism: https://blog.synthetix.io/new-liquidation-mechanism/