1/ As all #DEFI users, I had to overcome the meaning of IMPERMANENT LOSS and how to play with it. SO here is my 4 months research gathered in one thread only for you. Ping it, as it will be useful during your whole DEFI Journey 🧵4⃣->3⃣->2⃣->1⃣->👇

2/ Problem: a)Very few people understand the meaning of Impermanent Lossb)People are loosing money due to IL and don’t know why

3/ Solution 1: Use that website to see how IL works

https://dailydefi.org/tools/impermanent-loss-calculator/

4/ Solution 2: Theory is 🤮: As soon as you deposit two tokens into a liquidity pool which prices are not correlated (token 1 price changes in a different % than token 2 price), Impermanent Loss occurs. When you withdraw from the LP, loss becomes permanent. Let's practice ->

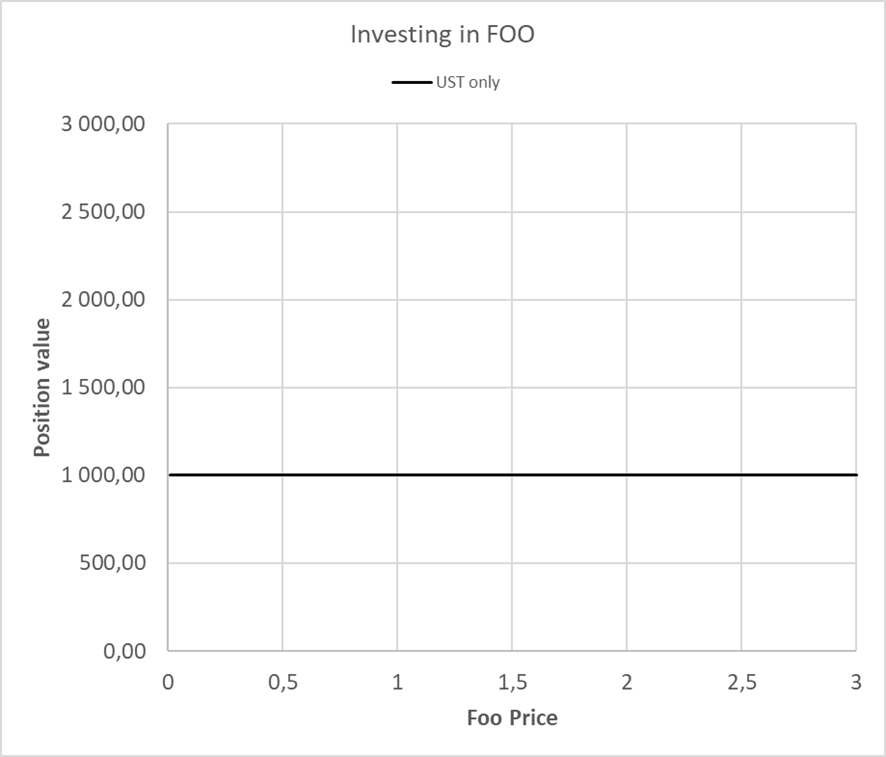

5/ As a drawing is 100x better than a 17 posts thread (shit!!), let’s start with an example: I’ve 1,000 $USDT and want to invest in one token, $FOO for example (I don’t care about $FOO, this is just an example right?). So I have multiple strategy:

6/ 1) I don’t invest in the token. My Portfolio stands still, and doesn’t really bother about $FOO price variation

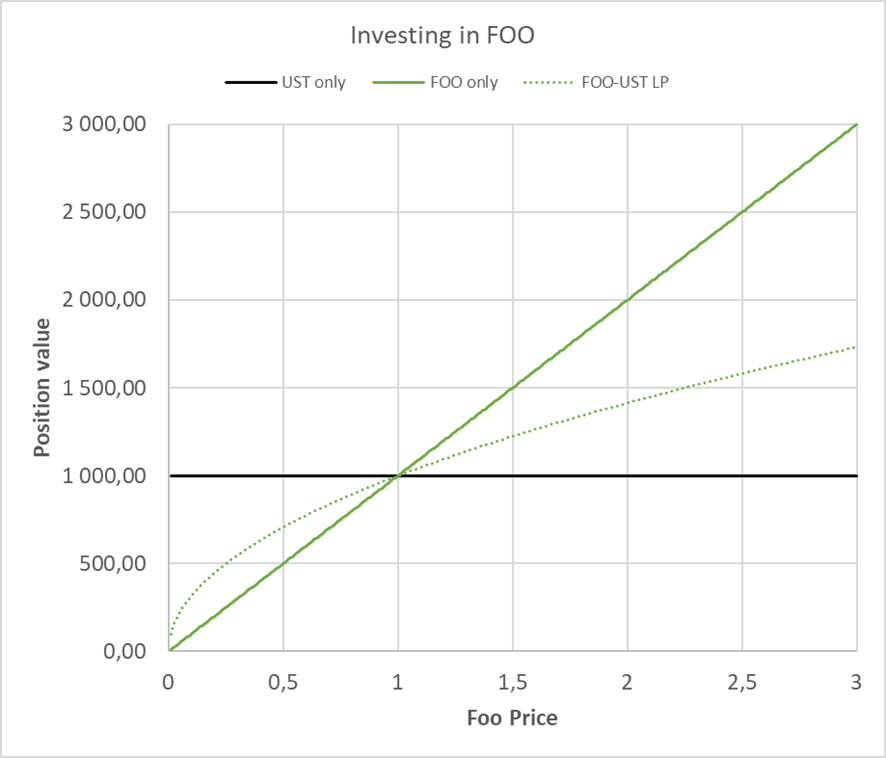

7/ 2) All-in on $FOO: $FOO goes to Zero I’m #REKT , $FOO goes to #Moon , @elonmusk send me there!!

8/ 3) I deposit 500$ in stable and 500$ in $FOO into a liquidity pool with 0% APR. I’m less rekted and less a moonboy than All-In strategy.

9/ 4) I keep 500$ of stable & 500$ of $FOO in my #web3 wallet. The you can see the Impermanent Loss "IL" showing his face between strategy 3 & 4. On the upper side you earn less, on the lower side you loose less.