1/ Who would like to understand the un-peg mechanism in a Liquidity Pool? Here is my 1st 🧵inspired by @DeFi_naly and @ChadMcchief techniques, thanks Bros. Example on $stETH / $ETH pool on #Curve:👇

2/ First of all, in #DEFI, token swap occurs in Liquidity Pool. The largest dex being @CurveFinance. If you want to be kept up to date on #curve and beyond, just follow this brilliant guy:

https://twitter.com/CurveCap?t=cgSlMV9-VU3oS3m2VEMa7w&s=09

3/ Token price in a LP follows a specific swap curve. @uniswap follows X*Y=K, but others like @CurveFinance or @VelodromeFi has specific swap curve for correlated assets

4/ Peg, i.e token average price over all DEXes/CEXes, is maintained as long as the ratio of the tokens inside the pool are balanced, such as the $sUSD / $3CRV pool from @synthetix_io

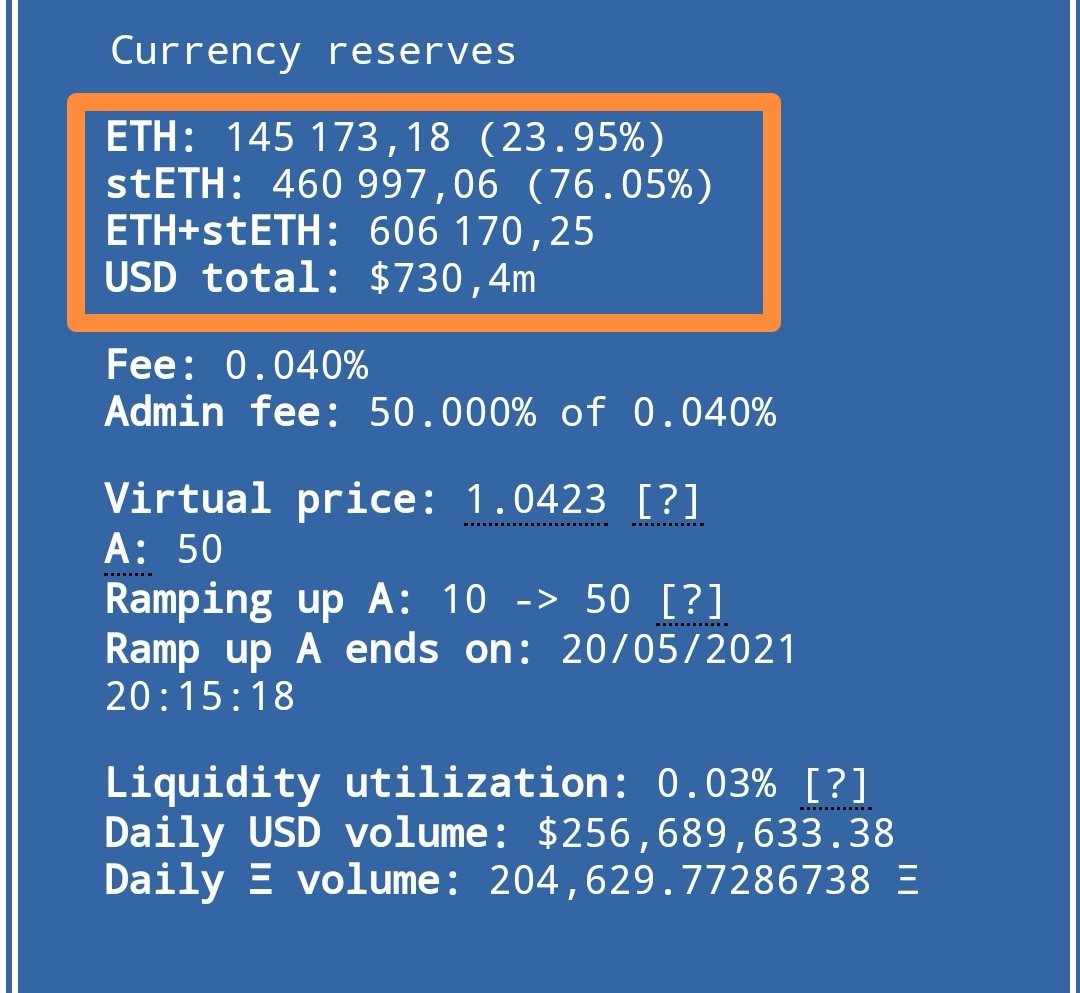

5/ however, above a specific threshold, peg is not anymore maintained, this is the perfect example of the @LidoFinance pool stETH/ETH.

6/ And this value depends on a specific A factor as explained by Mr Whale @Tetranode, just read and enjoy :https://twitter.com/Tetranode/status/1528981311569874944?t=JFRcpc2qHeiTW4Qcwbs_6Q&s=19

7/ This A factor is easily seen on #curve pool

8/ By changing "A" factor on this website

desmos.com/calculator/mbo…, you can simulate the price impact in case of imbalanced token ratio. If ratio is 50/50 peg is perfect.