As an investor of #DeFi, there is no discussion saying that #Ethereum holds all the Blue Chips. Unfortunately, some times gas prevents me to invest & farm on L1. Here are some tips to invest on @AlchemixFi and @0xconcentrator whithout interacting with #Ethereum #blockchain 💪👇

These two protocols innovate by creating a liquid version of the autocompounding value behind their governance token, and added liquidity on other #blockchains to allow users / protocols to use it.

Alchemix Finance Governance token is the $ALCX, only available on #Ethereum Mainnet

Alchemix created the $gAlcx, which is the staking proof of deposit of $Alcx.

https://twitter.com/AlchemixFi/status/1504083138166861827?s=20&t=TdvOHkHYlTDVxEMKb2QQ4Q

So when investing in $gALCX you actually invest in $Alcx + stake it, for 1/100 of the fees on #ethereum. Currently available on #Fantom but soon on other chains.

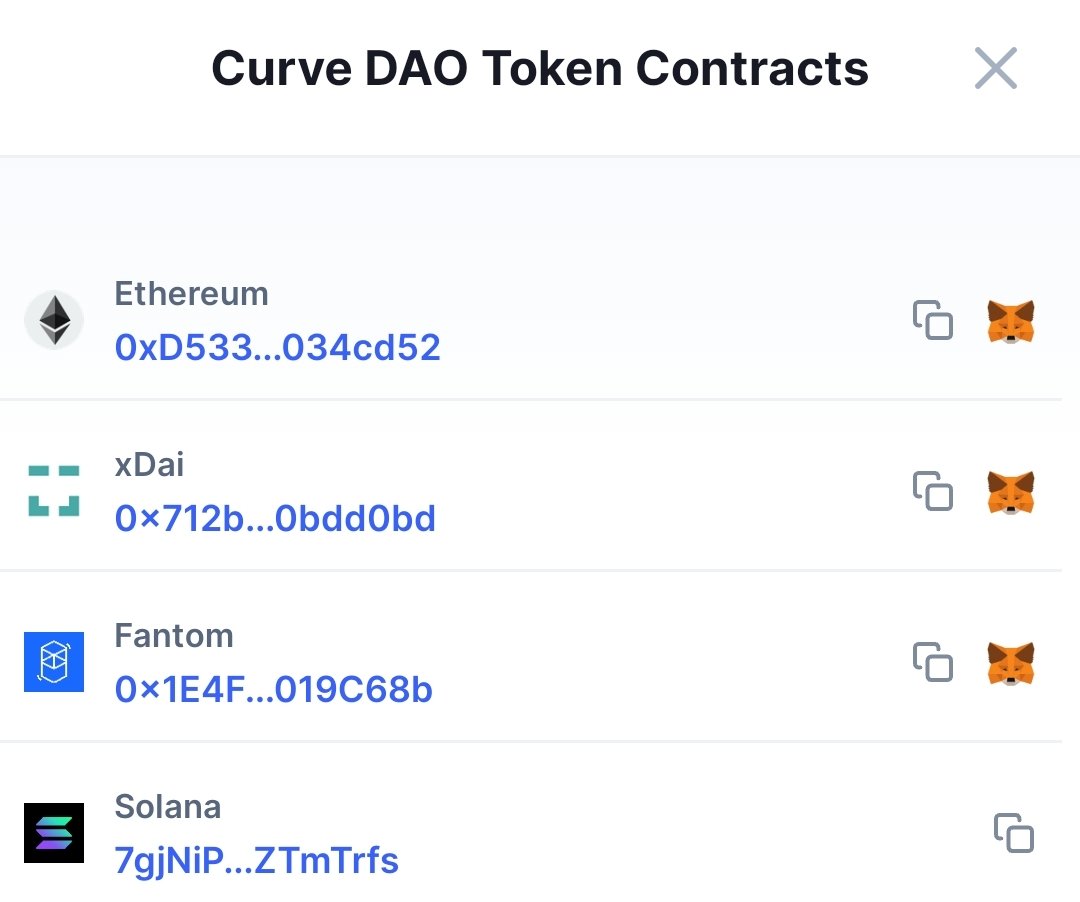

Curve Finance governance token is the well known $CRV only available on those chains: and honestly, didn't find any liquidity on #Fantom, so would be happy to know where.

Concentrator created the $aCRV which represents the autocompounding version of $cvxCRV pegged 1:1 to $CRV. More info on this video:

Concentrator (Yield Optimizer) - All you need to know: IFO, tokenomics, fees, farming strategy

Despite having the token available on #Arbitrum, #Polygon and #Fantom, liquidity was shallow until the team added large liquidity on #Polygon:

https://twitter.com/0xconcentrator/status/1552933807082405891?s=20&t=mpfBiwS1D_xBgu4vDCj6Hg

So investing in the $aCRV equals $CRV plus the autocompounding rewards.

You can now invest + farm these two blue chips while transacting on low gas fees blockchain. But more utilities of these wrapped tokens would be to use them as collateral on lending protocols on @AaveAave, or as a yield bearing asset in a liquidity pool on @BalancerLabs