1/ Have you ever heard a world where #DeFi rewards are automatically harvested & reinvested? Welcome in the #YieldOptimizer World. Here is a 🧵why they are one of the first door to open for newcomers in #DeFi 👇Concrete example on @optimismPBC with @beethoven_x & @beefyfinance

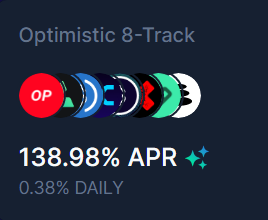

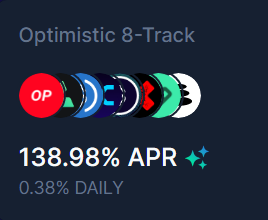

2/ When you deposit into a Liquidity Pool, you receive token(s) reward based on the #APR of this pool. APR stands for: Annual Percentage Rate. On @beethoven_x , this pool is made up of 8 #tokens, with an APR of 139%$OP $LYRA $USDC $SNX $BEETS $sUSD $PERP $BAL

3/ As you may know @beethoven_x is a friendly fork of @BalancerLabs coming from #Fantom who deployed their platform on #Optimism. Reward of this pool are split:- 37% of swap fees => your LP token will increase in quantity- 102% liquidity mining => Reward received in $BAL

4/ So let's say you want to take your $BAL and re-invest it in the LP, you have to:1-Harvest reward2-Deposit $BAL into the pool (@beethoven_x will take care to split your deposit into an equal amount of the 8 tokens)3-Stake your LP token

=> 3 operations each time = 3xfees

5/ Mind that other DEXes can either offer multiple token rewards, or don't not have this "ZAP" function that distributes automatically your deposit into the different tokens of the LP. So 3 operations can turn into 10 transactions 💵💵💵

6/ If you'd like to reinvest every week ♻️, that makes 10*52 = 520 transactions 😱. So either you don't have time, or the transactions fees will exceed your rewards. Fortunately, specific protocol exists to help you and do the work for you:

7/

@beefyfinance is one of them. It's called a Yield Optimizer. It will harvest and autocompound the reward for you, transforming APR into APY = Annual Percentage Yield. If you want to know the difference between APR and APY, please check this site: