1- Listening to the last live from @redactedcartel, and sorry to say but those guys are BUILDING. After #HIDDENHAND deployment cumulating 1m$ of Bribes, now it's their #PIREX solution that is live. Here is a simplified description of the 3 possible #farming strats 👇

2.1- Easy Mode: Auto-compounder -> $uCVXDeposit $CVX, and let your quantity of $CVX increasing. Very interesting for retails with small portfolio to avoid gas fees to collect bribes. This strat is built in partnership with #Union from @0xAlunara👇

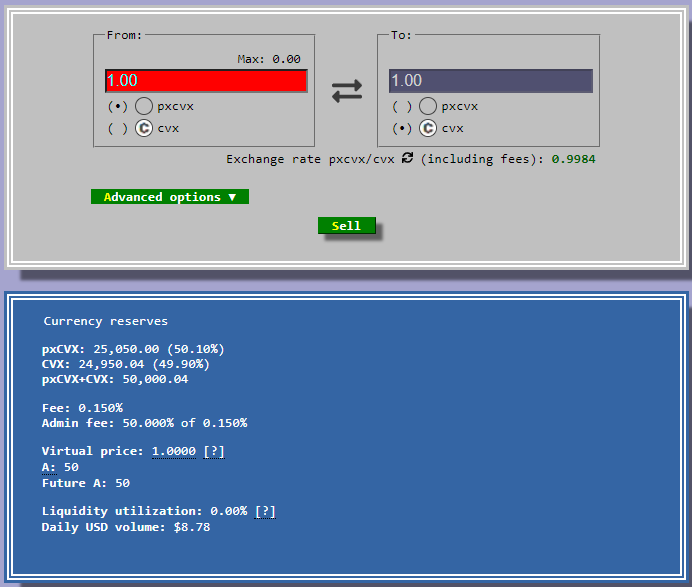

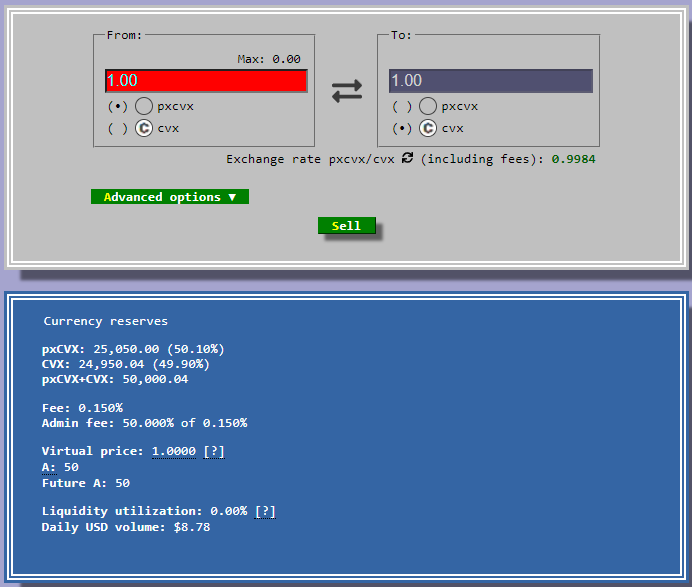

2.2- Standard Mode: Liquid wrapped version of $CVX (either through redemption or on a @CurveFinance liquidity pool) -> $pCVX@redactedcartel confirms it will maintain Pool's peg, and will allow LPers to earn:- LP fees + gauge directing $CRV emission- Bribes

2.3- Expert Mode: A bit like @APWineFinance, trade your future yield -> $spxCVX + either tokenized vote power OR tokenized bribe claim. Will be available soon.#Pirex becomes then A yield derivatives marketplace.But more has been Alpha'ed by the team during this live👇

3. Roadmap for #Pirex:- Deploy Pirex on another protocol (more specific to stablecoins)... @CurveFinance ??- Develop #composability of $uCVX & $pxCVX within the #DeFi ecosystem (lending, farming)- Use future yield to buy goods- 42,5% of revenues going to $rlBTRFLY stakers

4. I'm clearly interested in the value driven by @redactedcartel, especially as the Gov Proposal is ongoing for moving to the V2 Tokenomics. If you'd like more info about this, check this video, please put subtitles in as video is in 🇫🇷

Redacted Cartel - Le contrôle de la gouvernance des protocoles DEFI

5. As ve-Tokenomics keep increasing, and DEFI protocols will still look for incentivizing liquidity,

@redactedcartel positions itself as the only protocol to be able to capture this whole flow of value!

Erratum:

Quick correction about the revenues generated by PIREX: