1/ Do you want to add a #YieldFarming layer on top of the most well known #DeFi projects such as @CurveFinance , @ConvexFinance and @fraxfinance ? Composability, leverage farming, yield optimizing you said? Let's go through @0xC_Lever, an @aladdindao project 👇🧵

2/ @0xC_Lever allows user to take a self repaying loan without the risk of being liquidated. Deposit $CVX as Collateral, Borrow $clevCVX as debt, swap it for more $CVX. Rince & Repeat for a 2x leverage effect.You can also repay your debt at anytime.

3/ @0xC_Lever is currently on Beta mode, and in September-22, together with their Token Launch $CLEV, you will be able to leverage your $CVX and benefit from the full power of the protocol.

4/ Token launch? Yes!! $CLEV will be available for a period of 7 days where you will be able to buy against 1x $CVX up to 100k $CVX. But what's $CLEV utility? Lock it for 4 years and enjoy:- Governance Vote- Protocol Revenue Sharing, min 75% go to lockers pocket!

5/ @0xC_Lever will supply liquidity onto a $clevCVX / $CVX pool on @CurveFinance. And what will the project be doing with the acquired 100k $CVX? Most likely vote to incentivize the above Pool, so LPers will benefit from @0xC_Lever voting power also!

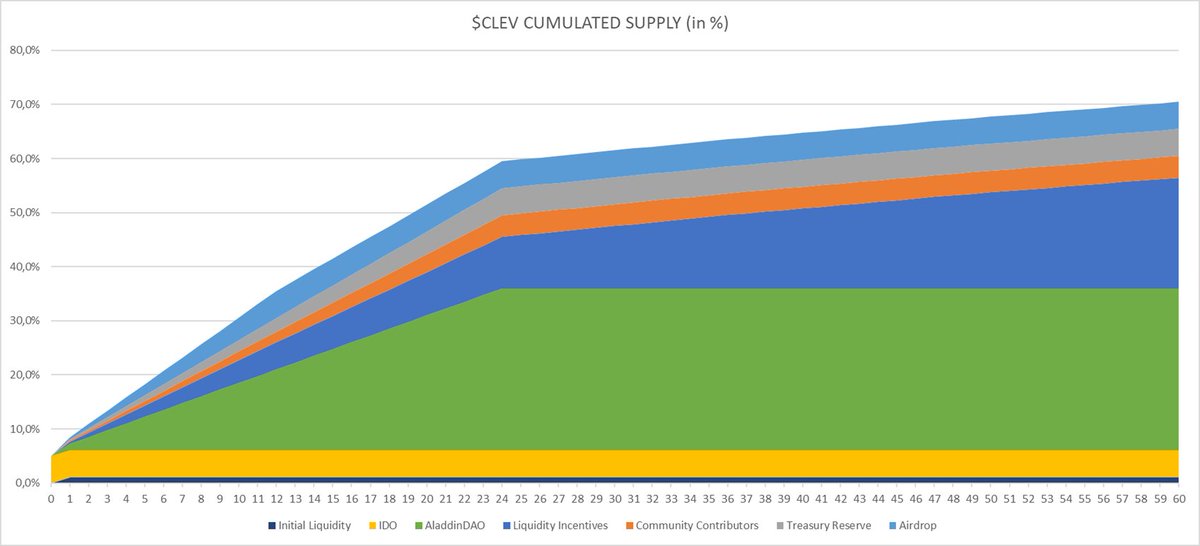

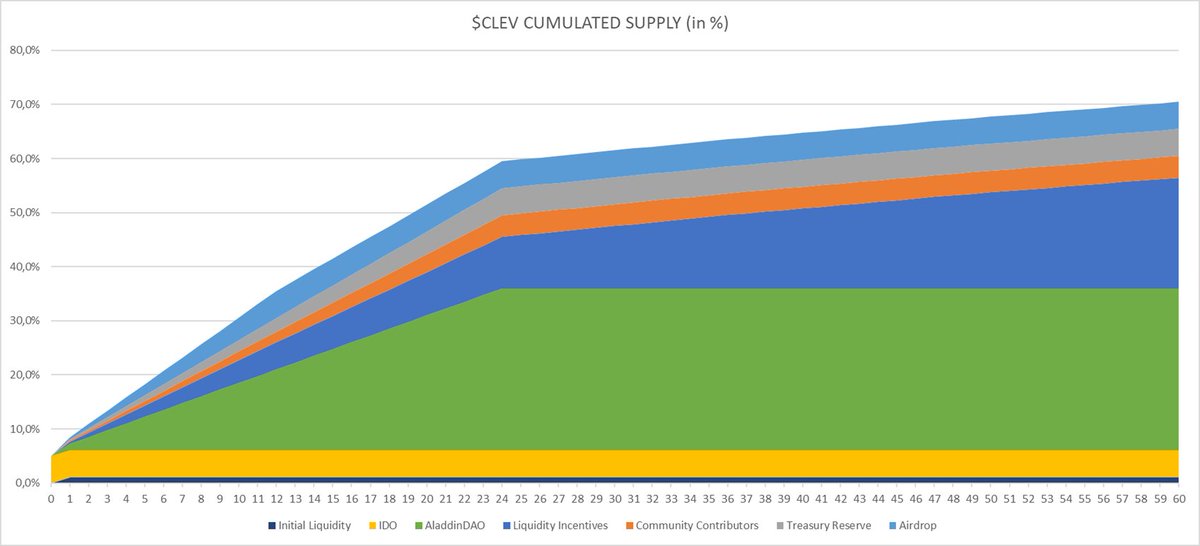

6/13 Tokenomics: Here is the supply curve for the coming 5 years.

7/ But that doesn't stop here, i'm still amazed about smart people in #Crypto !!

@0xC_Lever partnered with @fraxfinance in order to leverage Stablecoin Farming, more info here:

https://twitter.com/0xC_Lever/status/1567899078658523142?s=20&t=jBNCapDIztZ4hNncYNgHIw

8/ But what's the point: Ok, first do you remember @0xconcentrator, the yield optimizer on top of

@ConvexFinance and @fraxfinance? For the last summary, please check here:

https://twitter.com/Subli_Defi/status/1564283949836341248?s=20&t=NcNhI_KoDJhrupRGaAUlow